Call a licensed insurance agent.

(877) 713-2870 CALL NOW

Medicare Supplement Plans Basics

Medicare Supplement Insurance covers some of the costs that Original Medicare doesn't pay.

What is a Medicare Supplement Plan?

Medicare Supplement Insurance is also called "Medigap" because it helps fill gaps in costs not paid by Parts A and B including copayments, coinsurance and deductibles. Medicare Supplement Insurance Plans are easy to comparison shop because they are standardized under federal law, which requires each plan to offer the same basic coverage, regardless of the carrier.

For many plans, the only difference is the cost.

Why Medicare Supplement Insurance?

Having Medicare Supplement Insurance in addition to Original Medicare may help protect you from unexpected costs, giving you access to the care you need with peace of mind.

Guaranteed Issue means that you can’t be denied coverage due to a pre-existing condition, not that it can’t be taken away. The plan is guaranteed renewable as long as the premium is paid and a misrepresentation is not made on an application. SmartMatch licensed insurance agents work with you to ensure you get the coverage that meets your needs at the price that fits your budget.

Benefits of Medicare Supplement Insurance:

Guaranteed renewability each year

As long as you pay your premium, your coverage will continue year after year and cannot be cancelled (except in specific cases, like providing inaccurate information on your application).

Simplified plan options

Because Medicare Supplement Insurance is standardized, it’s fairly straightforward to understand and compare plans.

Nationwide network of doctors and specialists

Medicare Supplement Insurance enrollees can visit any doctor that accepts Medicare patients. Doctors or hospitals that accept Medicare patients MUST accept all Medicare Supplement Insurance Plans, regardless of the insurance carrier.

In addition to prescription coverage, some Medicare Advantage plans may offer additional benefits* depending on your service area such as:

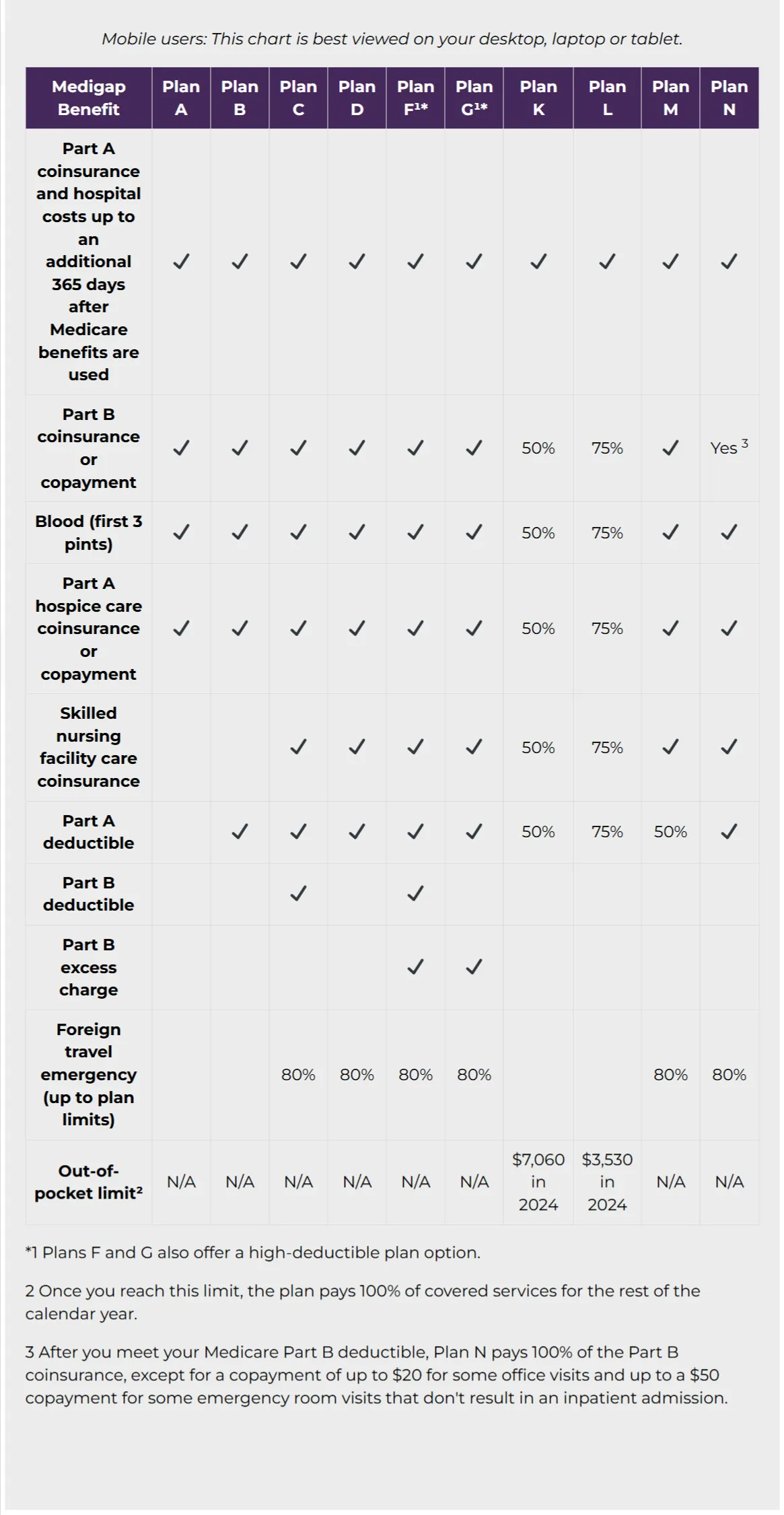

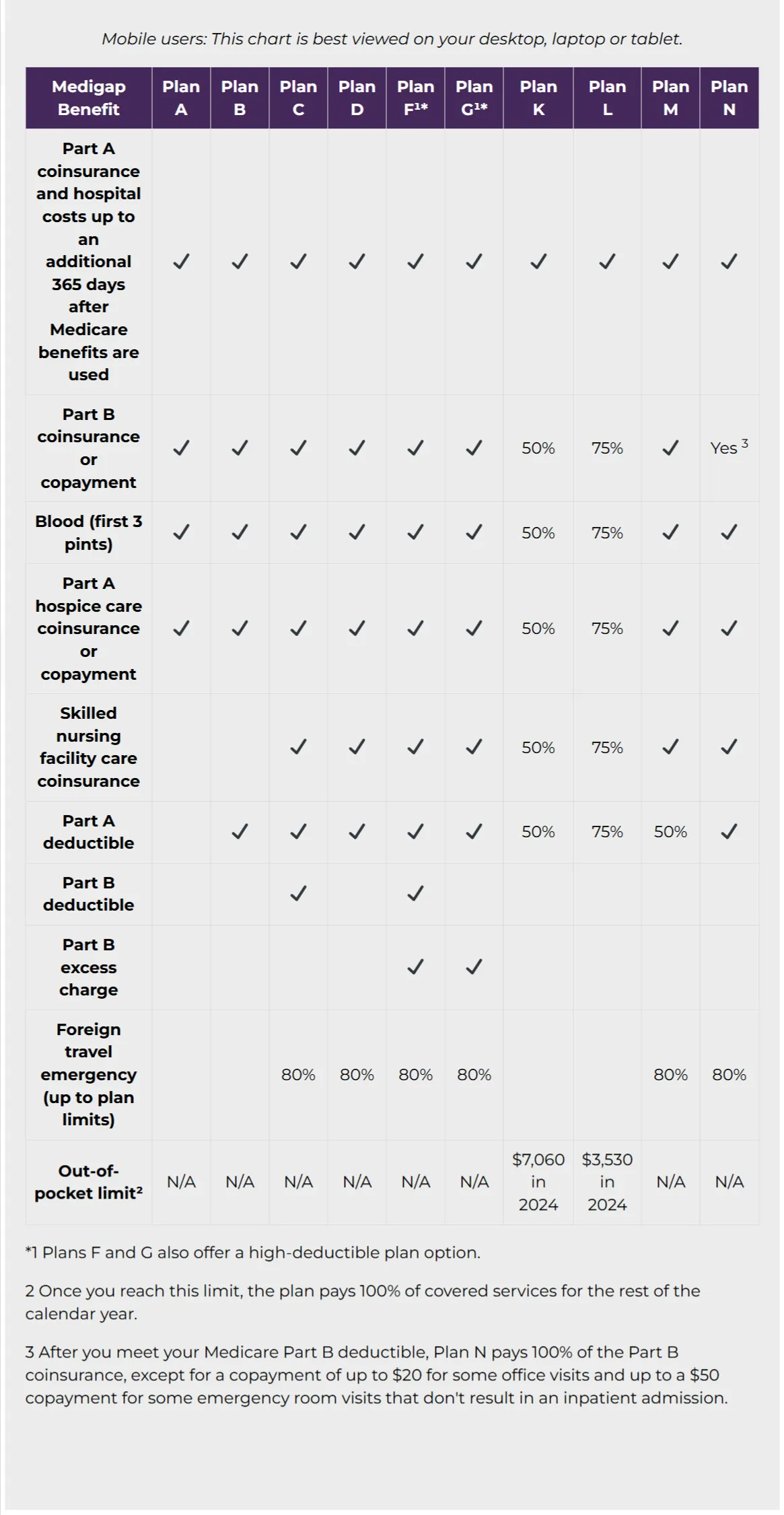

Plan Options and Comparison Chart

There are 10 standard Medicare Supplement Insurance Plan types available in most states, each with an assigned letter from A to N (Plans F and C are only available to those who were eligible for Medicare prior to Jan. 1, 2020).

Standardized Basic Benefits

All Medicare Supplement Insurance Plans must include the same standardized basic benefits regardless of the insurance company selling them.

Note: Medicare Supplement Insurance Plans generally do not cover dental, vision, and hearing costs, long-term care, or prescription drug costs, but they must cover at least a portion of the following basic benefits:

Medicare Part A coinsurance costs up to a year after Medicare benefits are exhausted

Medicare Part A hospice coinsurance care or copayments

Medicare Part B coinsurance or copayments

When is the best time to buy a Medicare Supplement Insurance Plan?

You cannot enroll in a Medicare Supplement policy until you have enrolled in Original Medicare (Parts A and B). After you have Original Medicare, you can choose to enroll in a Medicare Supplement Insurance policy during your Medicare Supplement Insurance Open Enrollment Period.

Open Enrollment Period

The Medicare Supplement Insurance Open Enrollment period is a once in a lifetime chance to enroll in a Medicare Supplement Insurance Plan in which an insurance company cannot use medical underwriting to decide whether to accept your application. The Medicare Supplement Insurance Open Enrollment period starts on the 1st day of the 1st month in which you turn 65 (or older) and are enrolled in Medicare Part B. Some states have additional Open Enrollment Periods, including those for people under 65. During this time, you can sign up for any Medicare Supplement Insurance Plan that suits your needs.

In most cases the best time to enroll in a Medicare Supplement Insurance policy is during your Medicare Supplement Insurance Open Enrollment Period as you may not be able to buy a Medigap policy after that, and even if you are able to, it may cost more.

During your six-month Medigap Open Enrollment Period, insurance companies are required by law to sell you any Medigap policy an insurance company offers regardless of any pre-existing conditions or health history. If you enroll after your Medicare Supplement Insurance Open Enrollment Period, (if, for example, you want to switch insurance carriers) you may have to answer health questions as insurance companies are generally allowed to use the medical underwriting process to decide whether to accept your application and how much to charge you for the Medigap policy, unless you have a guaranteed issue right under certain circumstances.

Guaranteed issue rights

The Medicare Supplement Insurance Open Enrollment period is a once in a lifetime chance to enroll in a Medicare Supplement Insurance Plan in which an insurance company cannot use medical underwriting to decide whether to accept your application. The Medicare Supplement Insurance Open Enrollment period starts on the 1st day of the 1st month in which you turn 65 (or older) and are enrolled in Medicare Part B. Some states have additional Open Enrollment Periods, including those for people under 65. During this time, you can sign up for any Medicare Supplement Insurance Plan that suits your needs.

In most cases the best time to enroll in a Medicare Supplement Insurance policy is during your Medicare Supplement Insurance Open Enrollment Period as you may not be able to buy a Medigap policy after that, and even if you are able to, it may cost more.

During your six-month Medigap Open Enrollment Period, insurance companies are required by law to sell you any Medigap policy an insurance company offers regardless of any pre-existing conditions or health history. If you enroll after your Medicare Supplement Insurance Open Enrollment Period, (if, for example, you want to switch insurance carriers) you may have to answer health questions as insurance companies are generally allowed to use the medical underwriting process to decide whether to accept your application and how much to charge you for the Medigap policy, unless you have a guaranteed issue right under certain circumstances.

What is a Medicare Supplement Plan?

Medicare Supplement Insurance is also called "Medigap" because it helps fill gaps in costs not paid by Parts A and B including copayments, coinsurance and deductibles. Medicare Supplement Insurance Plans are easy to comparison shop because they are standardized under federal law, which requires each plan to offer the same basic coverage, regardless of the carrier.

For many plans, the only difference is the cost.

Why Medicare Supplement Insurance?

Having Medicare Supplement Insurance in addition to Original Medicare may help protect you from unexpected costs, giving you access to the care you need with peace of mind.

Guaranteed Issue means that you can’t be denied coverage due to a pre-existing condition, not that it can’t be taken away. The plan is guaranteed renewable as long as the premium is paid and a misrepresentation is not made on an application. SmartMatch licensed insurance agents work with you to ensure you get the coverage that meets your needs at the price that fits your budget.

Benefits of Medicare Supplement Insurance:

Guaranteed renewability each year

As long as you pay your premium, your coverage will continue year after year and cannot be cancelled (except in specific cases, like providing inaccurate information on your application).

Simplified plan options

Because Medicare Supplement Insurance is standardized, it’s fairly straightforward to understand and compare plans.

Nationwide network of doctors and specialists

Medicare Supplement Insurance enrollees can visit any doctor that accepts Medicare patients. Doctors or hospitals that accept Medicare patients MUST accept all Medicare Supplement Insurance Plans, regardless of the insurance carrier.

In addition to prescription coverage, some Medicare Advantage plans may offer additional benefits* depending on your service area such as:

Plan Options and Comparison Chart

There are 10 standard Medicare Supplement Insurance Plan types available in most states, each with an assigned letter from A to N (Plans F and C are only available to those who were eligible for Medicare prior to Jan. 1, 2020).

Standardized Basic Benefits

All Medicare Supplement Insurance Plans must include the same standardized basic benefits regardless of the insurance company selling them.

Note: Medicare Supplement Insurance Plans generally do not cover dental, vision, and hearing costs, long-term care, or prescription drug costs, but they must cover at least a portion of the following basic benefits:

Medicare Part A coinsurance costs up to a year after Medicare benefits are exhausted

Medicare Part A hospice coinsurance care or copayments

Medicare Part B coinsurance or copayments

When is the best time to buy a Medicare Supplement Insurance Plan?

You cannot enroll in a Medicare Supplement policy until you have enrolled in Original Medicare (Parts A and B). After you have Original Medicare, you can choose to enroll in a Medicare Supplement Insurance policy during your Medicare Supplement Insurance Open Enrollment Period.

Open Enrollment Period

The Medicare Supplement Insurance Open Enrollment period is a once in a lifetime chance to enroll in a Medicare Supplement Insurance Plan in which an insurance company cannot use medical underwriting to decide whether to accept your application. The Medicare Supplement Insurance Open Enrollment period starts on the 1st day of the 1st month in which you turn 65 (or older) and are enrolled in Medicare Part B. Some states have additional Open Enrollment Periods, including those for people under 65. During this time, you can sign up for any Medicare Supplement Insurance Plan that suits your needs.

In most cases the best time to enroll in a Medicare Supplement Insurance policy is during your Medicare Supplement Insurance Open Enrollment Period as you may not be able to buy a Medigap policy after that, and even if you are able to, it may cost more.

During your six-month Medigap Open Enrollment Period, insurance companies are required by law to sell you any Medigap policy an insurance company offers regardless of any pre-existing conditions or health history. If you enroll after your Medicare Supplement Insurance Open Enrollment Period, (if, for example, you want to switch insurance carriers) you may have to answer health questions as insurance companies are generally allowed to use the medical underwriting process to decide whether to accept your application and how much to charge you for the Medigap policy, unless you have a guaranteed issue right under certain circumstances.

Guaranteed issue rights

The Medicare Supplement Insurance Open Enrollment period is a once in a lifetime chance to enroll in a Medicare Supplement Insurance Plan in which an insurance company cannot use medical underwriting to decide whether to accept your application. The Medicare Supplement Insurance Open Enrollment period starts on the 1st day of the 1st month in which you turn 65 (or older) and are enrolled in Medicare Part B. Some states have additional Open Enrollment Periods, including those for people under 65. During this time, you can sign up for any Medicare Supplement Insurance Plan that suits your needs.

In most cases the best time to enroll in a Medicare Supplement Insurance policy is during your Medicare Supplement Insurance Open Enrollment Period as you may not be able to buy a Medigap policy after that, and even if you are able to, it may cost more.

During your six-month Medigap Open Enrollment Period, insurance companies are required by law to sell you any Medigap policy an insurance company offers regardless of any pre-existing conditions or health history. If you enroll after your Medicare Supplement Insurance Open Enrollment Period, (if, for example, you want to switch insurance carriers) you may have to answer health questions as insurance companies are generally allowed to use the medical underwriting process to decide whether to accept your application and how much to charge you for the Medigap policy, unless you have a guaranteed issue right under certain circumstances.

Ready to get Enrolled?

Get Medicare guidance, solutions and support today

Or call a licensed insurance agent

1-888-411-7647

Senior Wellness Advisors

Corporate Office:

Atlanta, Georgia 30339

Business Hours:

Monday – Friday

8:00am – 6pm EST

Plans

Resources

Support

Company

Stay Connected

To learn the number of organizations and number of products we represent in your area, enter your ZIP code after clicking the button below.

This is a solicitation for insurance. Not connected with or endorsed by the U.S. Government or the federal Medicare program. Senior Wellness Advisors is licensed to sell insurance products in 10 states. Callers will be connected with a licensed agent who can enroll you into a Medicare Advantage, Prescription Drug (Part D and Medicare supplement insurance plan.

We do not offer every plan available in your area. Currently we represent 8 organizations which offer 3,299 products nationwide. Please contact

Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Not all plans offer all benefits. Availability of benefits and plans varies by carrier and location.

Limitations and exclusions may apply.

No obligation to enroll. Senior Wellness Advisors represents Medicare Advantage [HMO, HMO SNP, PPO, PPO SNP, and PDP] organizations that have a Medicare contract. Enrollment in any plan depends on contract renewal. PLEASE NOTE: Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease.

Medicare Plans

Medicare Advantage

Medicare Supplement

Medicare Part D

Ready to get SmartMatched?

Or speak to a licensed insurance agent